In the end, the most important thing is for you as the customer to understand the situation. I think Fidelity’s cash setup is more customer-friendly than that of Schwab. I find it amusing that Schwab is so chippy with Fidelity in this article Zero Confusion: Setting the Record Straight. Well, if you care what I want, then how about letting me have a choice?įor another comparison, Fidelity has an FDIC cash sweep available as well, but they also let me switch my “core position” (their term for default cash sweep) to a higher-yield money market fund like Fidelity Treasury Money Market Fund (FZFXX) which has an SEC yield of 4.23% as of 2/28/23 or Fidelity Government Money Market Fund (SPAXX) which has an SEC yield of 4.22% as of 2/28/23. Schwab will say “Oh, but our cash sweep is FDIC-insured! That’s what people want!”.

I may complain about how Vanguard is slipping in the customer service area, but this feature by itself is a major reason that I maintain my Vanguard brokerage account. If I make a sale or receive a dividend distribution, my Vanguard cash automatically waits in this low-cost fund and earns a competitive interest rate. They purposefully make the default profitable for them while making the alternative more hassle.įor comparison, Vanguard’s default cash sweep is the Vanguard Federal Money Market Fund, which has an SEC yield of 4.52% as of 2/28/23. Instead, their mandatory default cash sweep pays only 0.45% APY as of 2/28/23. However, let’s also be clear that if Schwab was truly client-first, then they would offer a high-yield, low-cost money money fund that would be paying 4%+ interest as their default sweep. This is why I post regular updates and monthly summaries of better banking options. They could all pay you more interest, but they don’t. Chase, Bank of America, Wells Fargo, they all make money by making money off your idle checking account balances while paying you nothing or 0.01% APY. But not to worry! Schwab is happy to report that “A growing portion of our client base is less prone to sorting.”įirst, some perspective.

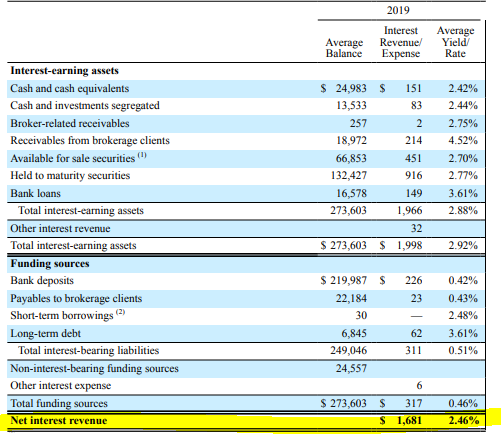

More sorting is bad for Schwab’s profits. The second one talks about “sorting”, which is basically when a customer realizes their cash is earning very little interest and actually puts forth the effort to earn some more interest by moving away from the default cash sweep options. The first one talks about the growth of “net interest revenue” over the years: Here are two sample slides from the Charles Schwab Corporation 2023 Winter Business Update, which is meant for shareholders. This “net interest revenue” added up to $3 billion dollars in 2022 Q4 alone and makes up roughly half of all their revenue. Even though Schwab will deny it publicly to retail customers, they have chosen to focus on skimming interest from their customers’ idle cash as a primary source of profits. Where they differ is how they choose to squeeze out profit in such a lean environment. These days, nearly every broker offers $0 commission trades on online equity/ETF trades. Charles Schwab became a major player by offering discounted stock trades back when high commissions were the norm.

0 kommentar(er)

0 kommentar(er)